The way the world works is changing. Our goal is to help businesses find new ways of working and we are leading the Intelligent automation Conversation for New Zealand. We’re on the forefront to help businesses transform their operating model to a future-focused way of working, build internal capability and find the sweet spots where automation can have the biggest impact on their organisation – with quantifiable benefit.

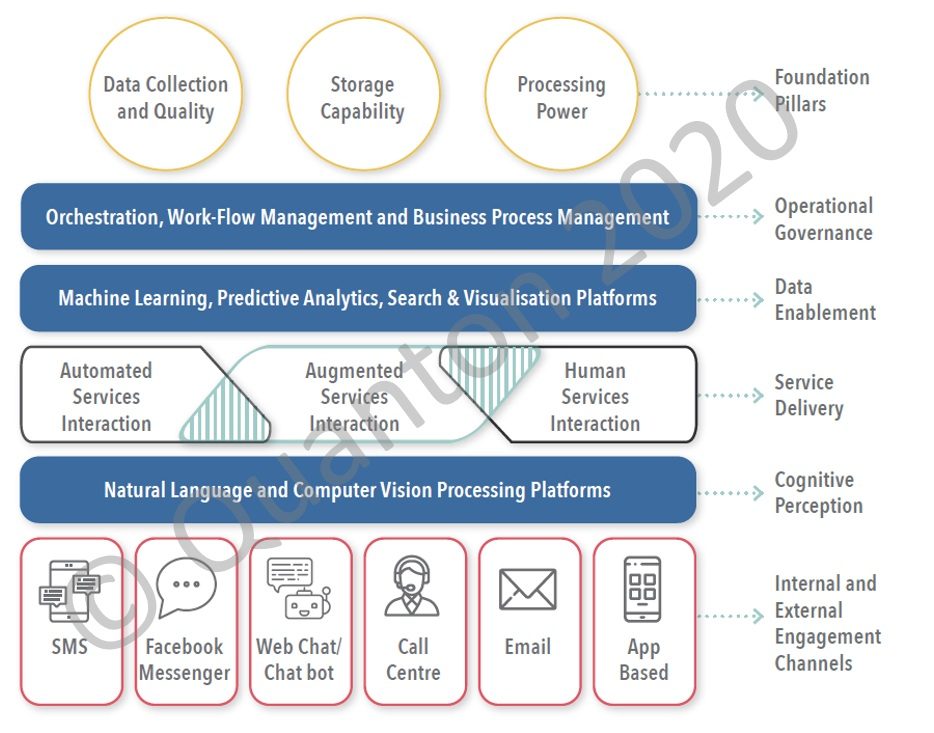

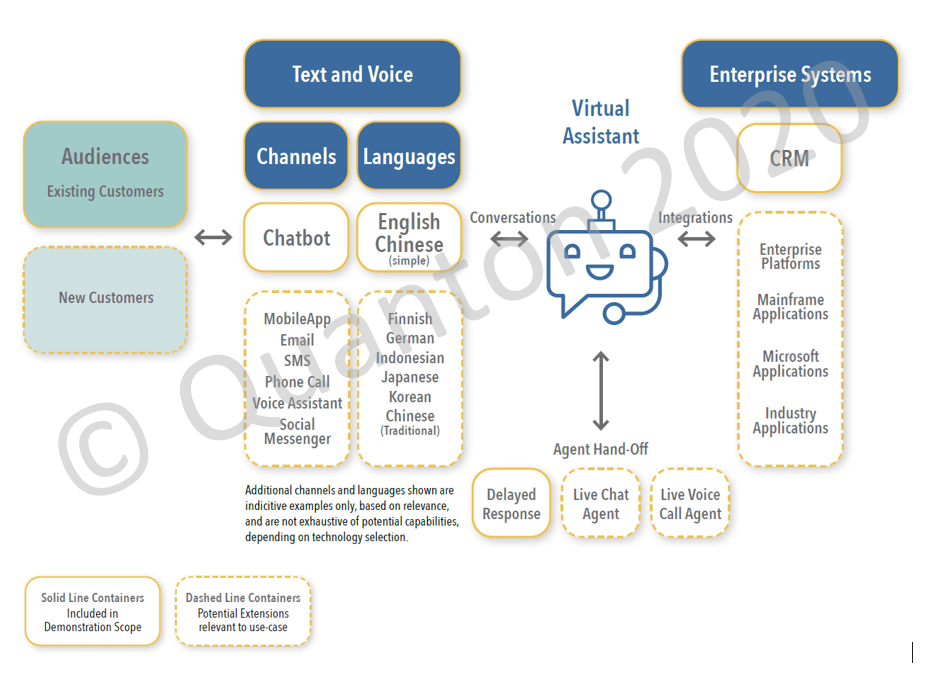

The ability for technology to engage with people, systems, and things to interpret information, structure data and form probabilistic outcomes for information-intensive processes in autonomous work execution.